Are you running your business, or is your business running you?

For many small business owners, how they pay themselves is the difference between long-term growth and financial chaos. Without a structured system, they struggle with unpredictable income, tax headaches, and limited reinvestment in business growth.

If this sounds familiar, you’re not alone—but there’s a better way.

In this post, you’ll learn:

- Why paying yourself a salary (instead of taking random draws) is critical for financial stability.

- A simple cash flow management system to keep your finances predictable and your business growing.

- The mindset shift required to transition from "owning a job" to running a business.

By the end, you will have a clear, actionable plan for controlling your finances and achieving sustainable success.

The Biggest Mistake Small Business Owners Make

Many small business owners make one fatal mistake: treating their business revenue like a personal piggy bank.

They pull money out whenever they need it—without a clear system—through a method called the owner’s draw. While this might seem convenient, it creates chaos in both personal and business finances.

Here’s what happens when you don’t control how you pay yourself:

- Unpredictable Finances – Without a set salary, it’s impossible to budget for personal expenses, leading to financial stress at home.

- Messy Taxes – Taking random draws means no tax withholdings, often resulting in underpaid taxes, not having the funds to pay taxes when they’re due, penalties, and surprise tax bills.

- Lack of Business Growth - Without structured finances, you limit reinvestment opportunities (hiring, marketing, equipment, etc.).

- No Professional Credibility - Banks and investors see financial disorganization as a red flag, making it more challenging to secure funding.

- Mental Burnout – Instead of running a business, you feel stuck in a job you own—leading to frustration and exhaustion.

The good news? You don’t have to stay stuck in this cycle. By implementing a smarter system, you can create stability, simplify taxes, and free yourself to run your business like a true owner.

How Small Business Owners Pay Themselves the Right Way

You gain control over your finances and future when you pay yourself with a structured salary.

The Benefits of a Salary-Based Pay System

- Financial Stability – A fixed salary ensures predictable income, allowing you to plan and manage personal expenses confidently. Control over household finances ensures you don’t drain the business to fund your lifestyle.

- Simplified Taxes – Automatic payroll tax deductions prevent tax season surprises and reduce IRS penalties.

- Business Growth – Clear financial separation keeps business equity intact, allowing for strategic reinvestments.

- Professional Credibility – A structured pay system makes you and your business more attractive to banks, investors, and potential partners.

- Mental Freedom – Knowing you have a solid financial system in place allows you to focus on growing your business instead of stressing over cash flow.

Fact: Poor cash flow management is the #1 reason 82% of small businesses fail (U.S. Bank Study). Paying yourself properly is one of the best ways to avoid this fate.

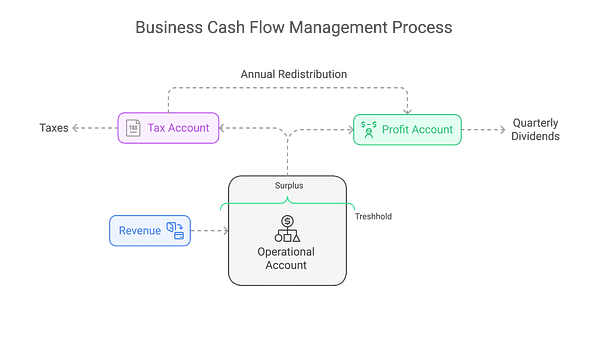

A Simple Cash Flow Management System for Business Owners

To make this work, you need a structured system to manage cash flow while ensuring your business remains profitable.

Step 1: Separate Your Business and Personal Finances

- Open a dedicated business operating account for all incoming revenue.

- Never mix personal and business expenses. That will protect you legally, simplify taxes, and prevent your business from being harmed by household financial decisions.

- You will use this operating account to pay our business expenses, including your salary and payroll taxes.

Step 2: Establish a Salary & Threshold System

- Set a baseline threshold for your operating account—aim for at least one month’s worth of business expenses (including salary).

- Any money beyond this threshold is considered surplus. You will strategically allocate your surplus.

Step 3: Implement the 50/50 Surplus Rule

Once you exceed your threshold in the operating account, divide surplus cash into two accounts:

- 50% to a Tax Account – Set aside funds for quarterly tax payments to avoid last-minute tax stress.

- 50% to a Profit Account – Used to pay yourself a quarterly dividend (bonus), reinvestments, and business expansion.

Step 4: Pay Yourself a Quarterly Bonus

- Every quarter, take 50% of your Profit Account balance as a dividend or bonus.

- After paying annual taxes, transfer leftover tax funds to your Profit Account.

Step 5: Build Business Reserves & Reinvestment Funds

- Aim to build reserves in your Profit Account equal to 12 months of operating expenses.

- Once reserves are secured, allocate the surplus into a business investment account for expansion opportunities.

Pro Tip: In case of emergency, break glass. If business slows down, don't abandon the system—use funds from the Profit Account instead of taking erratic draws.

This structured approach ensures financial predictability, tax efficiency, and long-term growth.

The Mindset Shift: Stop Owning a Job, Start Running a Business

Many entrepreneurs unknowingly own a job, not a business. Shift your mindset to that of one of a business owner.

How to Shift Your Mindset:

By shifting your mindset, you can move from financial chaos to financial control, ensuring both personal and business success.

Action Steps: How to Implement This Today

Ready to take control of your finances? Here’s what to do next:

- Commit to a structured pay system – Stop taking random draws and start managing cash flow strategically.

- Separate your business and personal finances – Open dedicated accounts if you haven’t already.

- Set a monthly salary – Determine a fixed amount you will pay yourself from business earnings.

- Establish your operating account threshold – Maintain a one-month expense buffer before taking bonuses.

- Create a tax savings account and a profit account – Be prepared to set aside revenue in surplus of your operating expenses for profit for taxes.

The sooner you implement this system, the sooner you’ll experience financial stability, peace of mind, and business growth.

It's Time to Level Up

If you want to take control of your business finances, it starts with paying yourself the right way.

A structured salary system isn’t just about stability—it’s about building a scalable, thriving business that works for you instead of the other way around.

Start implementing these strategies today and take the first step toward financial freedom and business success.

If you’re stuck, take my free Small Business Breakthrough Assessment. It evaluates the five key areas of your business—Sales & Marketing, Sales Conversion, Customer Service & Operations, Leadership, and Financial Management. You’ll get a clear picture of where you’re thriving and where you can improve.